21 Jul Enhancing Governance Through ESRS Compliance Benefits

Introduction

In the contemporary landscape of corporate governance, the integration of Environmental, Social, and Governance (ESG) considerations has emerged as a pivotal factor influencing organizational performance and stakeholder relations. Compliance with the European Sustainability Reporting Standards (ESRS) presents an opportunity for companies not only to align with regulatory requirements but also to enhance their governance frameworks. The ESRS, developed in response to the European Union’s commitment to sustainable finance and transparent corporate behavior, mandates comprehensive reporting on sustainability metrics that reflect a company’s impact on both the environment and society. This article explores the multifaceted benefits of ESRS compliance, highlighting how it can serve as a catalyst for improved governance practices. Through an examination of case studies, existing literature, and theoretical frameworks, this analysis aims to elucidate the ways in which adherence to these standards can fortify governance structures, enhance stakeholder engagement, and drive long-term organizational resilience. In doing so, it contributes to the broader discourse on the intersection of regulation, sustainability, and corporate governance, suggesting that ESRS compliance is not merely a regulatory obligation but a strategic imperative for contemporary organizations.

Table of Contents

- Enhancing Transparency and Accountability Through ESRS Compliance

- Integrating ESRS Frameworks into Strategic Risk Management Practices

- Promoting Stakeholder Engagement and Trust via ESRS Implementation

- Wrapping Up

Enhancing Transparency and Accountability Through ESRS Compliance

Compliance with the European Sustainability Reporting Standards (ESRS) facilitates enhanced transparency within organizations. By adopting these standards, companies are encouraged to disclose a comprehensive range of sustainability-related information, thereby providing stakeholders with insights into their operations, strategies, and long-term impacts. This approach enables organizations to create a clear narrative around their sustainability goals, allowing stakeholders—including investors, customers, and regulators—to evaluate performance effectively. Such transparency is not only vital for corporate reputation but also essential for fostering trust and loyalty among various stakeholders.

Moreover, adherence to ESRS fosters a culture of accountability within organizations. By establishing a framework for systematic reporting, businesses are more likely to align their sustainability goals with measurable outcomes. This alignment can lead to the development of **key performance indicators (KPIs)** that serve both as benchmarks for internal progress and as tools for external verification. Important aspects of this accountability include:

-

- Regular monitoring of sustainability initiatives through established standards.

-

- Engagement of stakeholders in the evaluation process, ensuring their perspectives are considered.

-

- Clear documentation of challenges and successes, thereby promoting organizational learning.

Incorporating ESRS compliance not only enhances transparency and accountability but also strengthens governance frameworks. A clear reporting structure allows for the identification of governance gaps and facilitates risk management by highlighting pertinent sustainability risks. The table below illustrates key aspects of governance that can be improved through effective ESRS compliance:

| Aspect | Impact of ESRS Compliance |

|---|---|

| Stakeholder Engagement | Improved trust and collaboration. |

| Risk Management | Enhanced identification and mitigation of sustainability risks. |

| Decision-Making | Data-driven insights lead to informed strategic choices. |

Integrating ESRS Frameworks into Strategic Risk Management Practices

Integrating the European Sustainability Reporting Standards (ESRS) into corporate risk management practices serves to align risk assessments with strategic objectives, promoting a culture of transparency and accountability. By adopting these frameworks, organizations can enhance their ability to identify and evaluate environmental, social, and governance (ESG) risks. This, in turn, facilitates informed decision-making processes that consider not only financial outcomes but also long-term sustainability goals.

Within this paradigm, the relationship between risk management and ESRS compliance is symbiotic. An essential aspect is the development of a structured approach that includes:

-

- Risk Identification: Recognizing potential ESG risks through comprehensive assessments.

-

- Risk Assessment: Evaluating the potential impact and likelihood of identified risks.

-

- Risk Mitigation Strategies: Implementing actions to minimize adverse effects associated with ESG risks.

This structured approach empowers organizations to more effectively integrate sustainability factors into their overall risk profiles, thereby enhancing the robustness of their governance frameworks.

Moreover, the imperative for organizations to embrace ESRS compliance creates a platform for dialogue among stakeholders. This can be operationalized through the establishment of governance committees focused specifically on ESG issues, resulting in:

| Benefits | Impacts |

|---|---|

| Increased Stakeholder Confidence | Encourages investment and customer loyalty. |

| Enhanced Regulatory Compliance | Reduces legal risks and potential fines. |

| Operational Efficiency | Optimizes resource allocation and management. |

Through these initiatives, organizations can not only ensure compliance with ESRS but also catalyze broader changes that positively influence their strategic risk management practices.

Promoting Stakeholder Engagement and Trust via ESRS Implementation

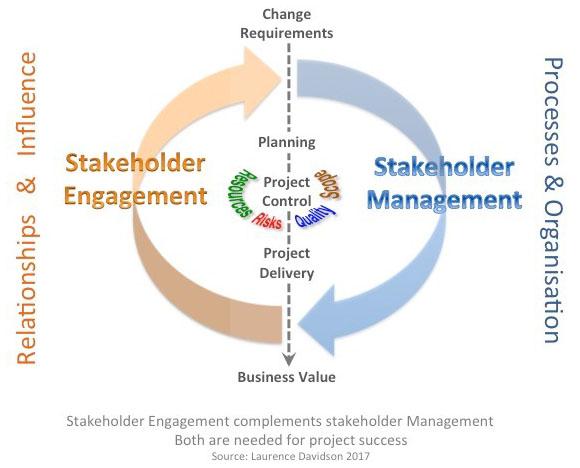

The implementation of the European Sustainability Reporting Standards (ESRS) fosters an environment conducive to **enhanced stakeholder engagement**. By establishing clear, standardized reporting frameworks, organizations are equipped to communicate their sustainability initiatives effectively. This transparency is pivotal in addressing stakeholder concerns and expectations, resulting in a more inclusive dialogue regarding environmental, social, and governance (ESG) matters. Stakeholders, including investors, employees, customers, and the community, benefit from consistent information, which enables them to make informed decisions and fosters a deeper connection with the organization.

Moreover, adherence to the ESRS enhances **trust-building efforts** between organizations and their stakeholders. When companies provide verifiable and accurate sustainability data, they demonstrate accountability and responsiveness to stakeholder inquiries. As stakeholders perceive a commitment to ethical behavior and social responsibility, they are more likely to establish positive relationships with the organization. This trust is further reinforced when organizations actively engage with stakeholders to discuss and integrate their feedback into sustainability strategies, thus creating a dynamic, participatory decision-making process.

the implementation of ESRS not only improves communication but also facilitates a culture of **collaboration and continuous improvement**. By embedding sustainability into core business practices, organizations can encourage joint initiatives and partnerships with stakeholders. These collaborations can take various forms, including co-developing sustainability goals and sharing best practices aimed at achieving mutual objectives. The following table illustrates the potential benefits of engaging with stakeholders through ESRS implementation:

| Stakeholder Group | Benefits of Engagement |

|---|---|

| Investors | Access to reliable data for responsible investment decisions |

| Employees | Increased morale and alignment with organizational values |

| Customers | Strengthened brand loyalty and trust in product sustainability |

| Community | Enhanced reputation and social license to operate |

Wrapping Up

the integration of the European Sustainability Reporting Standards (ESRS) into governance frameworks presents a pivotal opportunity for organizations seeking to enhance their operational transparency and accountability. Adhering to ESRS not only fosters a culture of sustainability but also aligns corporate objectives with broader environmental, social, and governance (ESG) imperatives. The benefits of compliance extend beyond mere regulatory alignment; they encompass improved stakeholder trust, better risk management, and enhanced decision-making processes. By embracing these standards, organizations can demonstrate their commitment to sustainable practices, thereby contributing positively to the socio-economic landscape. As the regulatory environment continues to evolve, the proactive adoption of ESRS will undoubtedly serve as a critical determinant of organizational resilience and long-term success in an increasingly complex and interconnected global context. Future research should focus on identifying best practices for ESRS implementation and exploring the measurable impacts on governance effectiveness across diverse sectors.

No Comments